Probe former DHFL Loss to Lenders: Union Bank

CBI has been receiving requests from the Union Bank of India has written to it to effectively probe the promoters of Dewan Housing Finance Corporations. Other than the promoters, the Union bank has called from a probe in the management of the Dewan Housing Finance Corporation Ltd. The ultimate reason for calling such a probe is the fact that Dewan Housing Finance has caused a total loss of Rs 40,623.36 crores. What makes this debacle all the more concerning and debilitating is the fact that the loss was caused to the consortium of the bank, which is led by the Union Bank of India.

The basis of inquiry

The appeal to scrutinize dewan housing finance is based on the ultimate findings by the KPMG, the esteemed audit firm, that deviation of laid down norms and procedures have been committed seriously through manipulation of accounts and concealments. Dewan housing finance has been primarily accused of clandestine activities that were committed by it in terms of undisclosed bank accounts and misrepresentation.

given the seriousness of the claim at hand, the CBI has been actively probing the promoters namely Kapil and Dheeraj Wadhawan in the Yes Bank scam. According to the reports, given the pieces of evidence, there is a heavy case of fraud or loss of public money.

given the seriousness of the claim at hand, the CBI has been actively probing the promoters namely Kapil and Dheeraj Wadhawan in the Yes Bank scam. According to the reports, given the pieces of evidence, there is a heavy case of fraud or loss of public money.

But even though the claims of the consortium of banks seem legitimate, the federal agency effectively and emphatically cannot register a fresh FIR. This is merely due to the fact that there is a need or a want of general consent which needs to be accorded by the Maharashtra government.

Last year, in the month of August, in the aftermath of the infamous probe into the Dewan Housing Finance debacle, attempts were made for the manipulation of television rating points (TRP), the state government had effetely withdrawn consent that had been accorded to the CBI.

This was done under Section 6 of the Delhi Special Police Establishment Act. Thus, given the turn of events that had taken place in the case last year, it was made mandatory that general consent is a must for the federal agency, namely CBI, to register an offense in the state, in its absence. Thus, in totality due to the events of the past, the federal agency now has to effectively approach the state government. This will help them get access to permission to conduct the investigation on a case-to-case basis.

but is Maharashtra the only state to withdraw its consent? Apparently, many non-NDA governments, claiming serious vendetta by the center, have withdrawn their consent. These states mainly include Kerala, West Bengal, Rajasthan, Chhattisgarh, and Punjab.

The woes of the CBI have been aggravated as even after the portrayal, communication, and representation that has been effectively presented to the state government, consent hasn’t been still accorded. This brings to the forefront, the dreadfully awful state of the politics that tend to delay the process of recognition and effective addressal of the inconsistencies and corporate felonies at hand.

What makes this political deadlock all the more debilitating is the fact that the loss due to mismanagement and clandestine, illegal activities caused a loss of public money of over Rs 40,000 crores. Given the threat to social and public welfare, effective and immediate investigation is needed, which cannot go through due to the political deadlock.

To analyze the fraud, it is to be noted that the illegal tampering was found to have been conducted on a large scale as it was found that DHFL disbursed loans and advances totaling a total of Rs19,754 crores to 35 entities with commonalities to DHFL promoter. In fact, what made the whole process surreptitious and unnoticeable was due to DHFL promoters’ tight control of multiple entities. The control was so extensive that even the appointment of directors and auditors was carried out by the DHFL promoters.

It is no news that much of the debacle in the lending business is due to noncredit-worthy disbursement by the lender. The same was the case in the DHFL lending debacle, where it was found that humongous loans and advances to the tune of Rs 25,595 crores were disbursed to 65 entities that effectively and efficiently had various deficiencies.

These discrepancies and deficiencies included inadequate loan documentation and inadequate mortgage security valuation which form the very basis of the debacle. Similarly, to corroborate this claim, various loans can be found missing in the DHFL finance sheet that never made it back to the bank.

in fact to cover up the surreptitious activities of the corporations, the “Bandra Book entity” had been created which effectively and wrongly maintained the details of non-existing retail loans. This was created using dummy names which were maintained in a separate accounting system.

Thus, in totality, it can be argued that the DHFL debacle brings to the forefront the fact that a strong regulatory environment is needed to end clandestine activities that are conducted craft fully under the authorities’ eyes.

Terms related to the article:

union bank, DHFL loss to lenders, dhfl loss, union bank net banking, union bank of india net banking, union bank online.

Given the objectives of the RBI regulation, it is quite sagacious to mention what might be the impact of such regulations. It is to be noted that the newer regulations have posed some urgency within the financial institutions and the banks.

Given the objectives of the RBI regulation, it is quite sagacious to mention what might be the impact of such regulations. It is to be noted that the newer regulations have posed some urgency within the financial institutions and the banks. Thus, given the nature of the issue and the relevance and importance of such robust censoring and payment system, the recent regulations will greatly safeguard the users’ data. This has all the more important as data privacy concerns are becoming a big concern for users across the globe now. Thus the regulations will emphatically ensure that surveillance and right monitoring will ease out in the investigations.

Thus, given the nature of the issue and the relevance and importance of such robust censoring and payment system, the recent regulations will greatly safeguard the users’ data. This has all the more important as data privacy concerns are becoming a big concern for users across the globe now. Thus the regulations will emphatically ensure that surveillance and right monitoring will ease out in the investigations.

But in the pursuit to eradicate the non-conforming, non-perfect aspect of the asset, will the government forgo the positive potential of the currency? Luckily, the answer might come as good news for the investors, as the government plans to roll out its regulated version, CBDC, in the market.

But in the pursuit to eradicate the non-conforming, non-perfect aspect of the asset, will the government forgo the positive potential of the currency? Luckily, the answer might come as good news for the investors, as the government plans to roll out its regulated version, CBDC, in the market. Thus, one can finally state that the phased introduction of CBDC in India will possibly lead to a more efficient, robust, regulated, and legal tender-based payments option for the public which will be an added advantage. Though, it cannot be denied that there are associated risks with such introduction which, in the light of protecting the welfare of the user, need to be carefully evaluated, but given the potential benefits in the future, one can robustly state that something efficient can be born out of the meticulous efforts of the central bank.

Thus, one can finally state that the phased introduction of CBDC in India will possibly lead to a more efficient, robust, regulated, and legal tender-based payments option for the public which will be an added advantage. Though, it cannot be denied that there are associated risks with such introduction which, in the light of protecting the welfare of the user, need to be carefully evaluated, but given the potential benefits in the future, one can robustly state that something efficient can be born out of the meticulous efforts of the central bank.

The Story of India’s Weak Indian Power Sector

The Story of India’s Weak Indian Power Sector

Such a claim can be corroborated by the fact that diesel and petrol automobile purchase in India is dropping and the conventional market is facing tough competition from its electrical competitors.

Such a claim can be corroborated by the fact that diesel and petrol automobile purchase in India is dropping and the conventional market is facing tough competition from its electrical competitors. Further, it is to be noted that this scheme will be emphatically carried on the welcoming lines of how subsidies under EV policies can be availed of. What needs to be paid attention to is the fact that how will government implement the subsidy implementation plan?

Further, it is to be noted that this scheme will be emphatically carried on the welcoming lines of how subsidies under EV policies can be availed of. What needs to be paid attention to is the fact that how will government implement the subsidy implementation plan? The major call for such incentives was seen when provisions were made for 775 acres of land for EV manufacturing facilities. On top of this, it was also witnessed that some preferential market access for EV manufacturers was also being provided for the enticement process for further manufacturing.

The major call for such incentives was seen when provisions were made for 775 acres of land for EV manufacturing facilities. On top of this, it was also witnessed that some preferential market access for EV manufacturers was also being provided for the enticement process for further manufacturing.

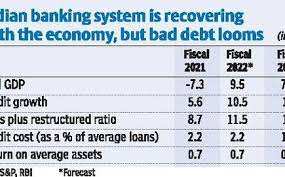

As it is quite widely known that the banking sector is booming as the Indian economy is gaining momentum. But with the rise of credit, delinquency is on the rise too. But here it is worthy of mentioning that Medius, using its Predict-Act-Reduce technology (P-A-R) is successfully attempting to mitigate the NPA crisis in the Indian banking sector.

As it is quite widely known that the banking sector is booming as the Indian economy is gaining momentum. But with the rise of credit, delinquency is on the rise too. But here it is worthy of mentioning that Medius, using its Predict-Act-Reduce technology (P-A-R) is successfully attempting to mitigate the NPA crisis in the Indian banking sector. On the other hand, the problem is all set to be exacerbated by the moratorium that was provided by the government on bank loan repayments.

On the other hand, the problem is all set to be exacerbated by the moratorium that was provided by the government on bank loan repayments. Medius also emphatically believes in reducing inefficacies and reductant human participation in the bad debt resolution sector as these are the very reason for the uninformed, odious and inefficient debacle. It is no news that with the plummeting relevance of the IBC in effectively dealing with the NPA crisis in the economy, due to its falling robust edifice of the timely resolution, Medius has rightfully descended in the industry with its preventive technology for the survival of the sector.

Medius also emphatically believes in reducing inefficacies and reductant human participation in the bad debt resolution sector as these are the very reason for the uninformed, odious and inefficient debacle. It is no news that with the plummeting relevance of the IBC in effectively dealing with the NPA crisis in the economy, due to its falling robust edifice of the timely resolution, Medius has rightfully descended in the industry with its preventive technology for the survival of the sector.

ARCs recover a part of the asset.

ARCs recover a part of the asset.

The examinations done on the 1997 murkiness found that the expense for Singapore alone arrived at US$163.5–US$286.2 million, with the best effect on the travel industry during the time of the murkiness.

The examinations done on the 1997 murkiness found that the expense for Singapore alone arrived at US$163.5–US$286.2 million, with the best effect on the travel industry during the time of the murkiness. Practically these fires currently appear to be preventable, since they are intentionally set to clear land for development.

Practically these fires currently appear to be preventable, since they are intentionally set to clear land for development. Hence, other significant sorts of logical examination additionally merit proceeded with help from outside sources. The haze resulting from the fires in Indonesia has caused severe economic and environmental damage in the region and will continue to do so if no prompt and effective measures are taken.

Hence, other significant sorts of logical examination additionally merit proceeded with help from outside sources. The haze resulting from the fires in Indonesia has caused severe economic and environmental damage in the region and will continue to do so if no prompt and effective measures are taken.

Considering its size, and dominant position in the market with 66 percent market share in new business premium, its growth rate may not match up to some of the nimble-footed private insurers.

Considering its size, and dominant position in the market with 66 percent market share in new business premium, its growth rate may not match up to some of the nimble-footed private insurers.