Evergrande China’s Lehman Brothers Moment

The 2008 Lehman brother’s debacle may be on play in China. With the high possibility of default, Evergrande brings back the stories of the 2008 financial crisis.

This emphatically tells us that leading firms can be quite crucial for the fate of the economy as a whole. This is due to the very pertinent fact that they can ruin a nation and pull a nation together.

But can Evergrande be the Lehman brothers’ moment for China? This calls for speculation and inspection. According to reports, Evergrande is cash strapped and has emphatically missed its payments that were due on Monday.

Given the trend that is playing out at the real estate giant, it can be stated that further payments of interest and principal amounts too cannot be expected of it.

Additionally, if the nature of the debt is to be scrutinized owns a total of $300 billion debts to two crucial, large banks of China. With the nonpayment of dues, an economic fallout for such banks can be likely.

But will the fallout be limited to the banks in the Chinese economy? The answer is an emphatic no. Various experts and analysts are worried that the debt default can have repercussions not only for the Chinese economy but also for the world economy.

This is due to various basic reasons like globalization and how integrated the Chinese economy is with the world market. In fact, China is the biggest importer and exporter of goods in the world market.

Thus with a slump in its economy due to huge fallout, one can expect lower demands and thus losses to various sectors and companies in the global market.

But it is to be noted that China isn’t exactly like the US in the financial year 2008. These have various reasons, firstly, the reach and impact of the USA were far much more than China, at least in terms of currency.

But it is to be noted that China isn’t exactly like the US in the financial year 2008. These have various reasons, firstly, the reach and impact of the USA were far much more than China, at least in terms of currency.

Secondly, the fed was quite reluctant in bailing out Lehman’s brother and had not anticipated the huge worldwide repercussions.

But given the character of the Chinese government, where everything is controlled by the government, it is quite unlikely that the government will allow such social upheaval, that it values the most.

Thus the impact and the extent of the debacle will depend on the government’s willingness to contain the social and financial upheaval a messy Evergrande collapse could cause.

Evergrande- a story of another debacle

If the reports are to be believed, it is to be noted that Evergrande has been conferred with the title of the most dubious title of the world’s most indebted real estate developer.

It has a wide network of real estate projects in the Chinese economy with 1,300 real estate projects around 280 cities. This shows the extent of spread and reach of the real estate sector.

Talking about the liabilities of the firm, as aforementioned, it stands at a humungous at $300 billion. With the striking numbers, the leaders have mentioned that they do not have the prerequisite funds to fund the debt. This has got the investors inside and outside China worried about a potential contagion effect.

The contagion effect means that turmoil or crisis in one large corporation can easily spread to others. these fears have resurfaced due to the nightmares of the Lehman Brothers crisis that had had the worst contagion effect on the other major financial institutions too. These financial intuitions were strategically its trading partners.

The contagion effect means that turmoil or crisis in one large corporation can easily spread to others. these fears have resurfaced due to the nightmares of the Lehman Brothers crisis that had had the worst contagion effect on the other major financial institutions too. These financial intuitions were strategically its trading partners.

Secondly, the impact of the same can be huge given the current slowing economic conditions of the second-largest economy. With demand and investment in the economy already plummeting, another debacle that can affect the banking sector, whose crucial role is to lend, and the public, who are demand drivers in the economy, the impact of the same can be colossal.

Similarly, the very fact that China is the world’s second-largest economy is important. This in itself sends a message that whatever happens in China’s Evergrande, has an immense potential to affect financial institutions and nations around the world.

But are there any signs of the ripple effect yet? Yes, closer to home example is the Hong Kong stock exchange market. According to reports, Hong Kong’s Hang Seng Index fell significantly by 3.3 percent after the news of the Evergrande debacle hit the market. On the other hand, its properties index fell by a whopping and was significant 6.69 percent. It is to be noted that this was the lowest in 52-week.

Similarly, at the far end, US stocks too showed their uneasiness. According to reports, US stocks too showed their biggest drop since May. This was emphatically fueled by the Evergrande anxieties. Though certain mention about Fed anxiety is to be also made that has kept the investors on edge.

Not only has the stock market started showing the effects of the Evergrande debacle, but certain traces of it can also be found in the commodities markets. This is due to the fact that it had helped send the copper prices in the economy plummeting.

This was in fact nearly a one-month low. This is mainly due to the fact that the demand for the metal is plummeting which is emphatically used in the construction business.

Thus the only question that needs answering now is whether the Chinese government will step in to bail out the real estate corporation or will it stand by and let the market showcase its worst scenario of social and financial upheaval.

Terms related to the article:

evergrande lehman brothers, lehman brothers moment, lehman brothers crisis, lehman brothers collapse, lehman brothers bankruptcy, lehman brothers scandal, lehman brothers case, lehman brothers crash, china lehman brothers, fall of lehman brothers.

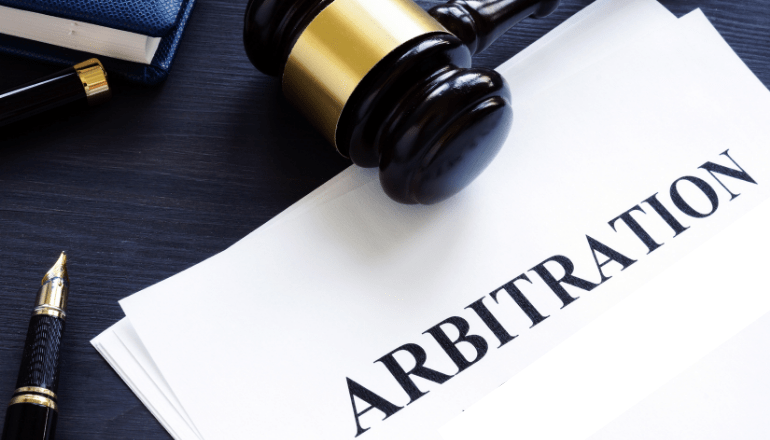

But has the insolvency takeover led to any significant suppression of descent? Perhaps not. many individuals, especially the

But has the insolvency takeover led to any significant suppression of descent? Perhaps not. many individuals, especially the  It is no news that IBC was effectively passed and implemented for the successful resolution of the insolvency cases in the economy and to effectively present time-bound resolution of the same.

It is no news that IBC was effectively passed and implemented for the successful resolution of the insolvency cases in the economy and to effectively present time-bound resolution of the same.

Thus, it can be argued that the issue of improving the digital lending sector should be viewed with the primary lens of consumer protection.

Thus, it can be argued that the issue of improving the digital lending sector should be viewed with the primary lens of consumer protection. Talking about business lending, there are key building blocks of lending and are extensively used in supply chain financing. Given the nature of the business, it is to be noted that largely finances flow to the supplier accounts which are paid back through an intermediary account.

Talking about business lending, there are key building blocks of lending and are extensively used in supply chain financing. Given the nature of the business, it is to be noted that largely finances flow to the supplier accounts which are paid back through an intermediary account. Given the already existing framework, India today stands tall to offer its citizens and businesses the benefits of universal credit access.

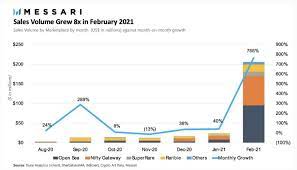

Given the already existing framework, India today stands tall to offer its citizens and businesses the benefits of universal credit access. Given its recent nature, it is quite extraordinary that it has recorded such a humungous growth. This also corroborates the fact that NFT is on the rise and is just in its nascent stage of development, mustering all the growing popularity in the global market.

Given its recent nature, it is quite extraordinary that it has recorded such a humungous growth. This also corroborates the fact that NFT is on the rise and is just in its nascent stage of development, mustering all the growing popularity in the global market. It is to be noted that NFTs that are digital creative works are actually premised on blockchains which work quite similarly to crypto. Blockchain technology which is quite permanent and has unchangeable digital ledgers provides the user the security of recorded transactions that reveal history.

It is to be noted that NFTs that are digital creative works are actually premised on blockchains which work quite similarly to crypto. Blockchain technology which is quite permanent and has unchangeable digital ledgers provides the user the security of recorded transactions that reveal history.

Talking about the recent announcement compared to the earlier archaic regulations, it is to be noted that as per SEBI’s amendments made to Alternative Investment Funds Regulations, 2012, Venture Capital Funds will need to invest at least 75 percent of investable funds.

Talking about the recent announcement compared to the earlier archaic regulations, it is to be noted that as per SEBI’s amendments made to Alternative Investment Funds Regulations, 2012, Venture Capital Funds will need to invest at least 75 percent of investable funds. But it is to be noted that such investment promotion comes as a series of steps. In October amendments were passed by Sebi that had amended the AIF regulations.

But it is to be noted that such investment promotion comes as a series of steps. In October amendments were passed by Sebi that had amended the AIF regulations.

With a high accommodative stance that was adopted by the

With a high accommodative stance that was adopted by the  It is to be noted that given the recent situation of burgeoning prices, the government needs to step in, soothe the apprehensions of the spenders in the economy. Given the massive recession that was witnessed by India last year, the country is still in the process of recovery.

It is to be noted that given the recent situation of burgeoning prices, the government needs to step in, soothe the apprehensions of the spenders in the economy. Given the massive recession that was witnessed by India last year, the country is still in the process of recovery.

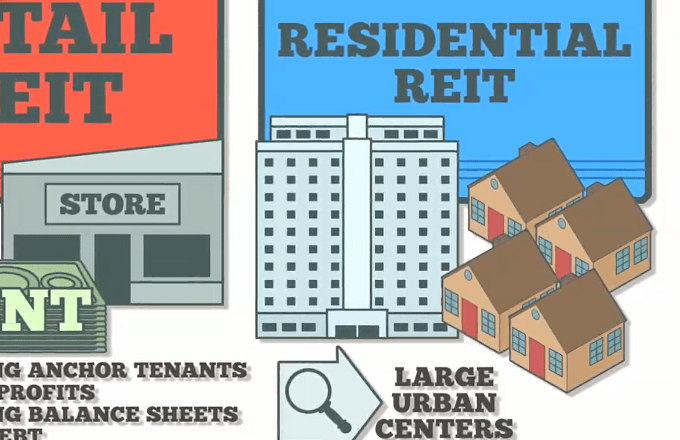

Given the aforementioned importance of infrastructure development in India, EITs and InvITs come into the picture. According to the reports the real estate investment trusts and infrastructure investment trusts have effectively raised capital up to $9.7 billion.

Given the aforementioned importance of infrastructure development in India, EITs and InvITs come into the picture. According to the reports the real estate investment trusts and infrastructure investment trusts have effectively raised capital up to $9.7 billion.

As aforementioned, as the InvITS and REITs will play a significant role in effectively funding the Government’s infrastructure plans, in addition to helping in meeting the asset monetization plans of the government it will also strategically help in meeting the capitalization requirements of banks.

As aforementioned, as the InvITS and REITs will play a significant role in effectively funding the Government’s infrastructure plans, in addition to helping in meeting the asset monetization plans of the government it will also strategically help in meeting the capitalization requirements of banks.

This brings various Payment aggregators like Razor pay, BillDesk and PayU under the ambit of the law as these have set up platforms like MandateHQ, SiHub, and Zion, respectively. These had been operating in the capacity to form or provide a “bridge” for banks to complete the transactions.

This brings various Payment aggregators like Razor pay, BillDesk and PayU under the ambit of the law as these have set up platforms like MandateHQ, SiHub, and Zion, respectively. These had been operating in the capacity to form or provide a “bridge” for banks to complete the transactions. Breaking down the

Breaking down the  it is to be noted that

it is to be noted that

The whole loan app debacle brings to the forefront the need for transparency, better data privacy laws, and a strong vigilance mechanism by the RBI to protect the interest of the public which is currently quite susceptible to harm financially and monetarily.

The whole loan app debacle brings to the forefront the need for transparency, better data privacy laws, and a strong vigilance mechanism by the RBI to protect the interest of the public which is currently quite susceptible to harm financially and monetarily.