Asset Monetization and Positioning on The Track

The pandemic has worsened the government’s finances to survive the arduous times of the public health care crisis in India. This has led the government monetization to run a fiscal deficit that might not materialize well for the fiscal health of the economy.

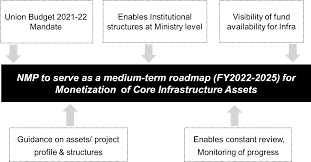

The government, in order to provide impetus to the economy, has unveiled a constructive, expansionary budget that will help raise funds. In addition to an expansionary budget, it has been witnessed that an asset monetization scheme too will contribute to replenishing the empty coffers of the government.

It is to be noted that NITI Aayog is effectively and intensely pushing the ministries to considerably accelerate the Union government’s asset monetization plans. This is being pursued to credibly and diligently achieve the current fiscal’s target that has been set by the government at the amount of Rs 88,190 crore.

Given India’s recent finance history, such a humongous fiscal deficit target set by the government is a delineating behavior from the precedent practices of the fiscal health of the economy.

Various ministries are being monitored to implement the crucial program by the Cabinet Secretary to emphatically ensure that part of the monetization plan is swiftly implemented and the targets are hit. If the monetization plan or the procedure is to be broken down, it entails the creation of new sources of revenue by substantially and efficiently unlocking the value or potential of the investments that are made by the government in public assets.

These are primarily focused on the public sector undertakings, which have not been yielding substantial or appropriate returns and are in desperate need of revamping in order to realize their utility and potential in the economy.

Thus, the government, in the recent budget, has come forward to unlock the lost potential and underutilization of such assets to raise revenues and thus replenish the emptying financial coffers of the government.

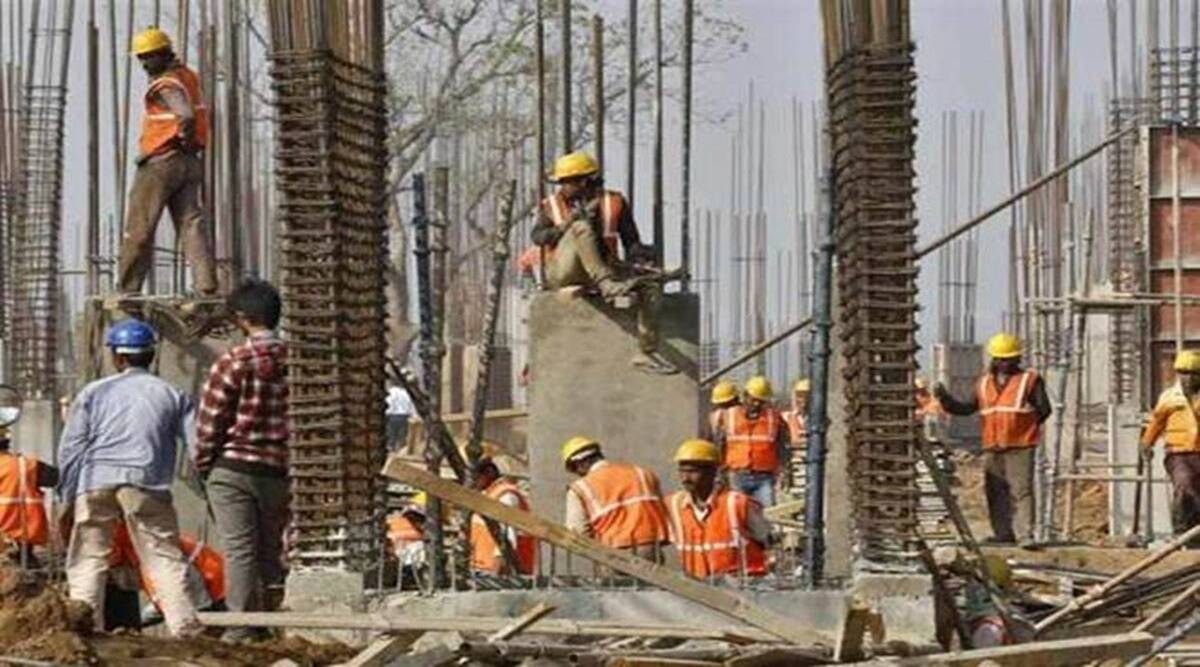

It is no news that government-regulated investments are usually seen as inefficient. Thus, in order to counter such a discrepancy, the government has invited the private sector to increase participation in the brownfield projects.

The plan has been efficiently concocted to make the aforementioned assets value-accretive, through substantial and efficient operation.

But what role do the ministries play in such a scheme of events devised by the government? It is to be noted that various brownfield assets that have been chosen include roads and the power sector where the concerned ministries are in charge.

Thus, these ministries are being forced or motivated by the government to complete their targets, as the petroleum, Railways, sports, and mining industries seem to be behind schedule. As a matter of fact, the railway ministry has been accused of being the biggest “laggard” after a change of guard. However the same cannot be maintained for all the industries in the market.

This is due to the impressionable and appreciable role that has been played by the Real Estate Investment Trusts and Infrastructure Investment Trusts or InvITs in the road and power projects.

In addition to the aforementioned real estate investment funds and the infrastructure investment trusts, public-private partnerships (PPPs) are also being highly preferred as the modes for asset monetization. This case can be scrutinized in the railways which account for humungous 25% of the Rs 6 lakh crore of assets that have been identified to be monetized.

According to the reports, it has been conjured that such PPPs will effectively help redevelop 400 railway stations around the countries. Other tasks at hand of PPP also include 90 passenger trains that need to run, leasing of the track on dedicated freight corridors, etc.

In the PPO agreement, in the specific case of the passenger trains, there is a model concession agreement that is in place to strategically operate these trains for a period of 35 years. This is being effectively achieved in return for an upfront payment.

In order to incentivize the private players, the private partner has been enticed with offers stating that the concerned parties have the right to collect fares and avail of the Railways’ maintenance infrastructure. Though, given the great incentive that is being provided by the government, the Railways is still falling behind in meeting the target that has been set for it at Rs 17,810 crore this fiscal.

This has led to a strategic revision in the policy and the terms that are being formulated to attract more participation from private players in the market.

One might ask what is the use of increased incentives, given the fact that private players will apparently witness spectacular profits which will definitely guarantee their participation? It is to be noted that undivided attention of the private players is needed for the Asset monetization plan.

The plan will effectively take off only when and if the private sector is on board. Thus, the delays which might come with expected profits, cannot be afforded. Therefore utmost transparency needs to be ensured for such participation. There must be a balance between risk and reward, between private and public interests.

It is to be noted that the ambitious, innovative project of the government will be seriously fraught with difficulties if the various projects that are cornered, have the participation of a few private parties.

Thus, in totality, it can be stated that the government’s incentives and undivided participation of the private players in the market are critical for the success of the asset monetization plan drafted by the government.

Also, Read Intellectual Property Rights

The timeline for such cash transfers has been provided till December 31. The association has also argued that the cash transfers can also effectively continue till the pandemic subsidies to support its workers, who have been hard hit by the arduous pandemic.

The timeline for such cash transfers has been provided till December 31. The association has also argued that the cash transfers can also effectively continue till the pandemic subsidies to support its workers, who have been hard hit by the arduous pandemic.

What made the Indian banking industry suffer the wrath of the covid more than the other countries was due to India’s despicable legacy of bad debt even before the COVID-19.

What made the Indian banking industry suffer the wrath of the covid more than the other countries was due to India’s despicable legacy of bad debt even before the COVID-19.

Having stated the government’s response to the dying ambitions of the Vodafone, how did the market take the news? The market response, at best, can be described as disappointing and averse. This has been corroborated through Vodafone Idea’s shares dipping by as much as 19% in early trade after the brutal announcement was made.

Having stated the government’s response to the dying ambitions of the Vodafone, how did the market take the news? The market response, at best, can be described as disappointing and averse. This has been corroborated through Vodafone Idea’s shares dipping by as much as 19% in early trade after the brutal announcement was made. Are such fears unwarranted?

Are such fears unwarranted?

and experts have cast their doubts on the issue of the government playing two roles at once in a sector.

and experts have cast their doubts on the issue of the government playing two roles at once in a sector.

The

The

Thus, given the government’s increased and necessary involvement in the innovative development of the sector, some thought should be put into the restoration of policy incentives. These efforts can be attributed to the weighted education in R&D expenditure and patent box.

Thus, given the government’s increased and necessary involvement in the innovative development of the sector, some thought should be put into the restoration of policy incentives. These efforts can be attributed to the weighted education in R&D expenditure and patent box. Mentioning the requisite role of the policymakers in the industry, the Creation of innovation hubs in the country, through motivating the right talent is always an overlooked, but important aspect that needs to be scrutinized.

Mentioning the requisite role of the policymakers in the industry, the Creation of innovation hubs in the country, through motivating the right talent is always an overlooked, but important aspect that needs to be scrutinized.

It is worth mentioning here that under the Corporate Insolvency Resolution Process, the creditors have placed ion the pinnacle of utmost importance. Thus, given its newfound, enhanced role, the committee of creditors has been emphatically seen playing a major role in the regime of insolvency.

It is worth mentioning here that under the Corporate Insolvency Resolution Process, the creditors have placed ion the pinnacle of utmost importance. Thus, given its newfound, enhanced role, the committee of creditors has been emphatically seen playing a major role in the regime of insolvency. Under particular regulation 21 of the code, the committee of creditors finds the seed of its formation. According to the code, the committee of creditors shall emphatically and strategically comprise all the financial creditors of the corporate debtor.

Under particular regulation 21 of the code, the committee of creditors finds the seed of its formation. According to the code, the committee of creditors shall emphatically and strategically comprise all the financial creditors of the corporate debtor. The power-wielding committee of creditors

The power-wielding committee of creditors The authority can also be effectively evaluated from the fact that the co9mmitee can also choose to proceed with the liquidation of the corporate debtor by not approving any resolution plan.

The authority can also be effectively evaluated from the fact that the co9mmitee can also choose to proceed with the liquidation of the corporate debtor by not approving any resolution plan.