Nationalization of banks in comparison to Covid effects on the Indian economy

If there are two things that have grabbed the political attention of the masses in India, it has to be the odious covid 19 pandemic that ravaged the already battered economy and the nationalization of the public assets.

Public assets, time and again have been a touchy subject for the masses of India. This is especially is true given the widespread notion or belief that government assets are invariably and emphatically public assets.

The government assets have been the talk of the town for two specific reasons. First is the selling off of the public’s property and heavy corporatization of the banking sector and secondly, the government’s close relations with the Ambani-Adani. With outrage pouring in from the masses the idea has become a contentious issue of debate.

Government’s inspiration

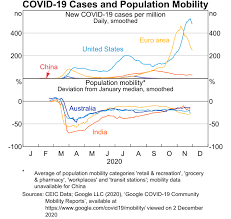

But what exactly inspired the government’s decision for disinvestment in the economy? The answer to the question lies in the arrival of the pandemic which severely affected and crippled the finances of the government.

With the need for robust public finance and expenditure in the economy, lower expenditure and finances spelled trouble for the battered economy. Thus, in order to finance the needs of the economy, the government innovatively thought of disinvestment of the public assets on which it could cash on.

But is disinvestment such a bad though Afterall? It is to be noted that privatization might actually ramp up the efficiency of the asset which had been reductant under the government’s rule. With higher NPAs in the public banking sector, the introduction of healthy competition can lead to the revamping of the banking sector.

What more pertinent reason for such a disinvestment spree can be? Given, the circumstances of the pandemic which the banking sector weathered, NPAs were reported to surge. Mortarium on payments and easy lending had put immense pressure on the banking sector.

Though many banks did reduce their NPA ratio, that was merely due to the act of writing off of the loans from the financial books.

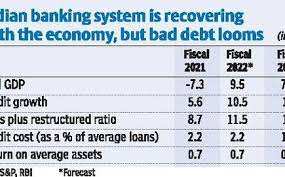

As a matter of fact, RBI’s Financial Stability Report of 2020 effectively and emphatically foresaw a huge surge in the Gross NPA ratio of the banking sector. This was projected to be at a significant 13.5 percent for the month of September for the financial year 2021. The NPAs were projected to heavily surge from 7.5 percent in September 2020.

What made the Indian banking industry suffer the wrath of the covid more than the other countries was due to India’s despicable legacy of bad debt even before the COVID-19.

Thus, one can strongly argue that as the odious variants of the virus despicably assailed the country which had pervasive and floundering health sector, the already battered pre-pandemic financial infrastructure, cracked and worsened.

The aforementioned situation is even more exacerbated for the public sector, which is inefficient even under normal circumstances. Thus, the government’s solemn decision to privatize certain banks and cash on them has some merit to it.

With increased efficiency and losses, one can effectively expect the better performance of the sector in the economy which is in the nascent stage of recovery.

However, taking an ill view of the banking sector too can be a biased opinion. With strict, increased monitoring, the immense increase in market capitalization in the stock market, and the introduction of stimulus packages, there is hope that green shoots for the sector and the economy are a possibility.

This can be effectively corroborated by the fact that throughout 2020-21, SCBs’ RoE and RoA sustained a positive rise of an impressive 6% in March 2021 on their CRAR. In fact, the GNPA and NNPA ratios too displayed signs of stability over a period of time, which spells good for the economy.

As aforementioned, last year, the moratorium on compound interest, which was sanctioned by the RBI, had a despicable effect on the bank’s finances. But it is to be noted that contrary to the earlier inferences, banks are now much better equipped to manage profitability.

Their resilience in terms of higher recoveries and as higher capital buffers too has been improved. Thus, one can maintain that the moratorium and the pandemic did have a silver lining for the banking sector.

Thus, in totality, disinvestment, which has been a petulant topic for the public, can be a step in the right direction for the industry. Given the immense importance of the banking sector in the economy, which drives the demand and the investment, its timely resolution is the need of the hour.

If this required extreme means, one should brace themselves for the inevitable. Thus, one should not be much abrasive or unappreciative of the scheme the government is concocting for the banking sector. As for the future, one can only be patient to witness what the scheme will offer for the industry and how will impact the economy in the long run.

Such a claim can be corroborated by the fact that diesel and petrol automobile purchase in India is dropping and the conventional market is facing tough competition from its electrical competitors.

Such a claim can be corroborated by the fact that diesel and petrol automobile purchase in India is dropping and the conventional market is facing tough competition from its electrical competitors. Further, it is to be noted that this scheme will be emphatically carried on the welcoming lines of how subsidies under EV policies can be availed of. What needs to be paid attention to is the fact that how will government implement the subsidy implementation plan?

Further, it is to be noted that this scheme will be emphatically carried on the welcoming lines of how subsidies under EV policies can be availed of. What needs to be paid attention to is the fact that how will government implement the subsidy implementation plan? The major call for such incentives was seen when provisions were made for 775 acres of land for EV manufacturing facilities. On top of this, it was also witnessed that some preferential market access for EV manufacturers was also being provided for the enticement process for further manufacturing.

The major call for such incentives was seen when provisions were made for 775 acres of land for EV manufacturing facilities. On top of this, it was also witnessed that some preferential market access for EV manufacturers was also being provided for the enticement process for further manufacturing.

As it is quite widely known that the banking sector is booming as the Indian economy is gaining momentum. But with the rise of credit, delinquency is on the rise too. But here it is worthy of mentioning that Medius, using its Predict-Act-Reduce technology (P-A-R) is successfully attempting to mitigate the NPA crisis in the Indian banking sector.

As it is quite widely known that the banking sector is booming as the Indian economy is gaining momentum. But with the rise of credit, delinquency is on the rise too. But here it is worthy of mentioning that Medius, using its Predict-Act-Reduce technology (P-A-R) is successfully attempting to mitigate the NPA crisis in the Indian banking sector. On the other hand, the problem is all set to be exacerbated by the moratorium that was provided by the government on bank loan repayments.

On the other hand, the problem is all set to be exacerbated by the moratorium that was provided by the government on bank loan repayments. Medius also emphatically believes in reducing inefficacies and reductant human participation in the bad debt resolution sector as these are the very reason for the uninformed, odious and inefficient debacle. It is no news that with the plummeting relevance of the IBC in effectively dealing with the NPA crisis in the economy, due to its falling robust edifice of the timely resolution, Medius has rightfully descended in the industry with its preventive technology for the survival of the sector.

Medius also emphatically believes in reducing inefficacies and reductant human participation in the bad debt resolution sector as these are the very reason for the uninformed, odious and inefficient debacle. It is no news that with the plummeting relevance of the IBC in effectively dealing with the NPA crisis in the economy, due to its falling robust edifice of the timely resolution, Medius has rightfully descended in the industry with its preventive technology for the survival of the sector.

ARCs recover a part of the asset.

ARCs recover a part of the asset.

The examinations done on the 1997 murkiness found that the expense for Singapore alone arrived at US$163.5–US$286.2 million, with the best effect on the travel industry during the time of the murkiness.

The examinations done on the 1997 murkiness found that the expense for Singapore alone arrived at US$163.5–US$286.2 million, with the best effect on the travel industry during the time of the murkiness. Practically these fires currently appear to be preventable, since they are intentionally set to clear land for development.

Practically these fires currently appear to be preventable, since they are intentionally set to clear land for development. Hence, other significant sorts of logical examination additionally merit proceeded with help from outside sources. The haze resulting from the fires in Indonesia has caused severe economic and environmental damage in the region and will continue to do so if no prompt and effective measures are taken.

Hence, other significant sorts of logical examination additionally merit proceeded with help from outside sources. The haze resulting from the fires in Indonesia has caused severe economic and environmental damage in the region and will continue to do so if no prompt and effective measures are taken.

Considering its size, and dominant position in the market with 66 percent market share in new business premium, its growth rate may not match up to some of the nimble-footed private insurers.

Considering its size, and dominant position in the market with 66 percent market share in new business premium, its growth rate may not match up to some of the nimble-footed private insurers.

Though, it is to be noted that the laws introduced to effectively prevent the misuse of the user’s data, such laws have effectively led to the curtailment of business in China.

Though, it is to be noted that the laws introduced to effectively prevent the misuse of the user’s data, such laws have effectively led to the curtailment of business in China. Thus, given the enormity of discrepancy and nonaccommodative environment that is brewing in China, it is perhaps time that China starts deep introspection of its laws that are not helping the business environment.

Thus, given the enormity of discrepancy and nonaccommodative environment that is brewing in China, it is perhaps time that China starts deep introspection of its laws that are not helping the business environment.

A fact that is backed by an organization of consequence carries weight. Hence, to add weightage to the argument stated above, the Japanese leading investment bank, namely Nomura. Has strategically stated that growing optimism in the market and abundant liquidity should boost loan demand in the future.

A fact that is backed by an organization of consequence carries weight. Hence, to add weightage to the argument stated above, the Japanese leading investment bank, namely Nomura. Has strategically stated that growing optimism in the market and abundant liquidity should boost loan demand in the future. This was done by harnessing cash flows in the economy to heavily improve their debt profiles, which had been faltering throughout the pandemic.

This was done by harnessing cash flows in the economy to heavily improve their debt profiles, which had been faltering throughout the pandemic. in totality, it can be stated that industry growth will emphatically emerge as a key driver to boost credit growth in the economy. Though, a word of caution is necessary that states that though India will witness an increase in loan demands, lags would still be prevalent.

in totality, it can be stated that industry growth will emphatically emerge as a key driver to boost credit growth in the economy. Though, a word of caution is necessary that states that though India will witness an increase in loan demands, lags would still be prevalent.

If the statistics are to be scrutinized, the pandemic inflicted woes on India’s retail sector that had shrunk by a significant 5 percent. But on the other hand, this opportunity was relished by the e-commerce sector which recorded a growth of a staggering 5 percent. This significantly had ramped up the valuation of the sector to a total valuation of $38 million.

If the statistics are to be scrutinized, the pandemic inflicted woes on India’s retail sector that had shrunk by a significant 5 percent. But on the other hand, this opportunity was relished by the e-commerce sector which recorded a growth of a staggering 5 percent. This significantly had ramped up the valuation of the sector to a total valuation of $38 million. Talking about the regulation of the e-commerce sector in India, it is to be noted that e-commerce in India does not pertain to a particular sector. Due to this analogy, different aspects of e-commerce are particularly regulated by various other regulators in a particularly fragmented manner.

Talking about the regulation of the e-commerce sector in India, it is to be noted that e-commerce in India does not pertain to a particular sector. Due to this analogy, different aspects of e-commerce are particularly regulated by various other regulators in a particularly fragmented manner. It is due to this attribute that the Competition Commission of India has been not been effectively and significantly be able to intervene in regulating such oligopolistic concentrations that are much more crippling in nature.

It is due to this attribute that the Competition Commission of India has been not been effectively and significantly be able to intervene in regulating such oligopolistic concentrations that are much more crippling in nature.

Certainly, if you are a finance enthusiast or a market spectator, chances are that you know that the government is not particularly kind to the digital member of the financial asset family.

Certainly, if you are a finance enthusiast or a market spectator, chances are that you know that the government is not particularly kind to the digital member of the financial asset family. Thus, clarity on the laws and propaganda of the government is needed. It should also provide crypto asset service providers with safe harbor–protection from liability for the actions of investors on their platform.

Thus, clarity on the laws and propaganda of the government is needed. It should also provide crypto asset service providers with safe harbor–protection from liability for the actions of investors on their platform. This is necessary as the players within the crypto-market will work to keep a check on each other’s activities, which will emphatically reaffirm the government’s idea of regulation.

This is necessary as the players within the crypto-market will work to keep a check on each other’s activities, which will emphatically reaffirm the government’s idea of regulation.