Understanding The Unilateral Appointment of Arbitrator

The whispers, arbitrariness, and confusion surrounding the topic of unilaterally appointing an arbitrator have been put to rest by the Delhi high court. The Court has emphatically and effectively stated that no party is allowed or could specifically be permitted to unilaterally appoint an Arbitrator. The aforementioned judgment is based on the rationale that such an attempt to appoint an arbitrator will significantly defeat the purpose of unbiased adjudication in the state of a dispute between the parties.

Though it is to be noted here that there was quite a huge accommodating stance by the disputing parties which were largely in the favor of the same, the recent court’s dismissal comes as a disheartening note for the petitioners. This can be corroborated by the fact that the crux of the petitions was emphatically and largely seeking for the appointment of Arbitrators for adjudication of disputes between the parties.

The case was being attended by the single-judge bench of Justice Suresh Kumar Kait. It was comprehensively noted here that dismissal was based on the principle of unbiased adjudication of disputes between the parties. This was enshrined in the Act and hence it can’t be compromised under any circumstances.

According to the petitioner firm, it has been conjured that a license agreement along with a supplementary agreement was entered between the respondent of shops that were under question and the petitioner. The agreement was strategically renewable every five years at the option of the specific petitioner.

The petition that was submitted maintained that after the change of name of the petitioner/firm from M/S Virender Kumar & Co. to M/S Sital Dass Sons, it was guaranteed an additional space. This additional space was guaranteed adjacent to shopping in the same shopping arcade.

This was effectively granted by the respondent to M/S Sital Dass Sons vide supplementary agreement. Here, it is to be noted that it also had included the terms of the original license agreement which were to be strategically and effectively read with the other agreement. Here, M/S Sital Dass Sons through its partners had informed the respondent about their preference of operating under two different names.

Given the smooth transition and agreement in the initial phases, on the ground, reality stuck hard.

According to the petitioners, it was found that in reality, the internal fittings of the aforementioned shopping arcade were disappointing as it was nearly 40 years old. What infuriated the petitioners was also the fact that there was an urgent and important need for repair and that it was no longer viable or financially profitable to continue with the shopping arcade. This was led by the respondent to vide a notice revoking the license in respect of the shops.

Here, it was contested by the petitioners that they were in exclusive possession of shops that were under consideration. The had further retreated that the notice hadn’t mentioned any violation of the conditions and terms of the license or lease agreement by petitioners.

This further brought to the fore the argument that petitioners had the right to carry on business at the hours suited to them. Thus, in its entirety, it was argued that the respondent on its will couldn’t have terminated the license or lease agreement.

The curious case of illegal eviction Additionally, it matters that had been also brought to the notice of the Court was that against illegal eviction of petitioners. They had emphatically and effectively preferred a civil suit CS(Comm)) 237/2020 before the Court for declaration and permanent injunction against the respondents. This was disposed of vide order on 21.07.2020 as not maintainable in view of the Arbitration clause between the parties.

Here, it is to be noted that the bench had stated that the arbitration agreement between the invocation of arbitration and the parties was not disputed by the respondents. Hence, in the entirety of the issue, the petitions under consideration deserved to be allowed.

However, as aforementioned that had led to the dismissal of the contention of petitioners to appoint Arbitrator of their choice. This was significantly done as no party could be permitted to unilaterally appoint an Arbitrator in the process of a dispute as this will quite unilaterally defeat the purpose of the Arbitration and Conciliation Act.

Here, it is worthy of mentioning that the Court had relied on the decision of the Supreme Court in Perkins Eastman Architects DPS v. HSCC (India) Ltd., 2019 SCC OnLine SC 1517. It was wherein it had been significantly and emphatically stated that in cases where one specific party has a right to appoint a sole arbitrator, its choice will always have an element of exclusivity.

This exclusivity will be determined or charted by the course for dispute resolution. Naturally, it was implied that the person who has any specific interest in the decision of dispute or outcome must not have the exclusive power to appoint a sole arbitrator of choice.

It is to be noted that the aforementioned decision was timely and ardently followed by the Coordinate Benches of this Court in VSK Technologies Private Ltd. v. Delhi Jal Board and the aforementioned Proddatur Cable Tv Digi Services v. Siti Cable Network Limited 2020 SCC OnLIne Del 350.

Hence, here the High Court had effectively appointed the sole arbitrator to adjudicate the dispute between the parties.

Adding to the above argument about the unilateral appointment of arbitrator, the court also positively envisioned that the fee of the arbitrator shall be effectively governed by the fourth schedule. The fourth schedule of the Arbitration and Conciliation Act, 1996 will help govern the fee of the arbitrator. Consequently, it was noted that the Arbitrator shall ensure compliance with Section 12 of the Arbitration and Conciliation Act, 1996. This should be effectively carried out before commencing the arbitration. This is all about the unilateral appointment of arbitrator.

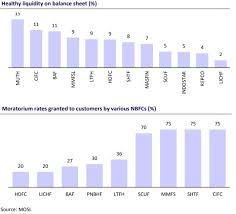

nger uncommon for NBFCs to tie up with banks and effectively engage in practices of co-lending.

nger uncommon for NBFCs to tie up with banks and effectively engage in practices of co-lending.

It is to be noted that retrospective tax in India was bid farewell in the recent past which was brought in due to the Supreme Court’s judgment in a landmark case. This had led the government in August to bring legislation into effect which had emphatically and effectively exempted indirect transfer of shares pursuant to transactions undertaken prior to May 28, 2012, from taxation.

It is to be noted that retrospective tax in India was bid farewell in the recent past which was brought in due to the Supreme Court’s judgment in a landmark case. This had led the government in August to bring legislation into effect which had emphatically and effectively exempted indirect transfer of shares pursuant to transactions undertaken prior to May 28, 2012, from taxation. It is to be noted that faceless assessment usually led taxpayers to approach the courts. This is due to the pertinent fact of natural justice which materializes due to the lack of an opportunity of being heard. This leads to an untimely and unwarranted load on the courts which are dealing with heightened and newer nuances due to the abolition of dividend distribution tax, in the financial year 2020.

It is to be noted that faceless assessment usually led taxpayers to approach the courts. This is due to the pertinent fact of natural justice which materializes due to the lack of an opportunity of being heard. This leads to an untimely and unwarranted load on the courts which are dealing with heightened and newer nuances due to the abolition of dividend distribution tax, in the financial year 2020.

The timeline for such cash transfers has been provided till December 31. The association has also argued that the cash transfers can also effectively continue till the pandemic subsidies to support its workers, who have been hard hit by the arduous pandemic.

The timeline for such cash transfers has been provided till December 31. The association has also argued that the cash transfers can also effectively continue till the pandemic subsidies to support its workers, who have been hard hit by the arduous pandemic.

What made the Indian banking industry suffer the wrath of the covid more than the other countries was due to India’s despicable legacy of bad debt even before the COVID-19.

What made the Indian banking industry suffer the wrath of the covid more than the other countries was due to India’s despicable legacy of bad debt even before the COVID-19.